It’s a double whammy.

Over the past decade, costs for immigration programs have increased. At the same time eligibility restrictions on green card and work authorization have tightened.

For some immigrant and mixed-status families, the financial burden is insurmountable. This, of course, makes the legal obstacles more difficult to overcome.

In some cases, the combination of these factors drive immigrants to seek help from scam artists and charlatans, as well as incompetent notarios and other service providers who charge low fees for misleading claims and exaggerated outcomes.

Or into a situation where they represent themselves, despite not having the faintest clue what various immigration rules and regulations mean.

Enter the Capital Good Fund.

The Capital Good Fund is a nonprofit lender that helps working-class immigrants navigate the expenses of the U.S. immigration system.

I learned about the company while browsing through immigration news stories on the internet.

Based on her income earned from two cleaning jobs, Tarver could not afford the bond amount on her own. She explains how the loan opened the possibility of success for her and her boyfriend.

“When I got the loan, it lifted a lot of weight off my shoulders. It was a miracle,” she said. “I don’t think he would have gotten out otherwise unless I sold things at a pawn shop, which I didn’t want to do.”

Now free, Tarver’s boyfriend awaits his next court date, which will determine whether he will be allowed to stay in the U.S.

As a seasoned deportation defense attorney, the difference between helping an immigrant who is incarcerated versus one who is not in detention is night and day.

And the reality is that immigration fees are continuing to rise.

The organization’s immigration loans range from $700 to $20,000, with annual interest rates between 16 and 24 percent.

Capital Good Fund, a Rhode-Island-based nonprofit that offers many types of personal loans, posits itself as a better, non-predatory alternative.

According to Andy Posner, founder and chief executive of Capital Good Fund, “Immigrants, whether they are documented or not, are loan-eligible.”

“We’ll lend regardless of immigration status,” he adds, “We don’t ask.”

Since its founding in 2009, immigration loans have accounted for about 12% of all of Capital Good Fund’s total loans. They have approved 271 loans, ranging from $700 to $20,000 for clients with immigrant needs. About 40% of applications are approved.

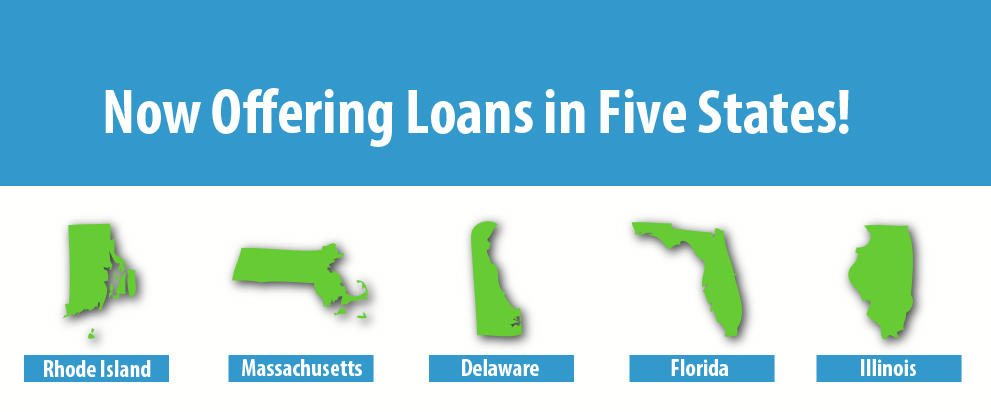

At the present time, Capital Good Fund only services clients living in Florida, Rhode Island, Deleware, Illinois, and Massachusetts.

The idea of a non-profit lender, offering loans at a lower rate than commercial banks and lending companies, is a concept that will hopefully expand into other states. Far too many deserving immigrants fail in their quest for legalization due to monetary limitations.

As Sheyla Velazquez, a Venezuelan immigrant interviewed by the Miami Herald noted:

“You know, when you come to the U.S., you are starting from scratch,” she said. “You have to work so hard to make rent, car payments, insurance, so many other types of expenses. The fact that there’s a way to make the immigration process faster and easier is a huge advantage for us.”

Part of the organization’s ability to help lower-income individuals is by soliciting donations from individuals.

If you would like to make a donation, click here: Capital Good Fund Donation Page.

Recommended Reading: